estate tax changes over time

That said laws change all the time. The good news on this arena is that the reduction of the estate and gift tax exemption from 10000000 as adjusted for inflation presently 11700000 per person will.

2018 Federal Estate Tax Law Changes

What this means is that an individual with an estate valued at up to 117 million can leave that amount to heirs without triggering estate tax.

. The first estate tax was enacted in 1797 in order to fund the US. How did the tax reform law change gift and estate taxes. However the law did not make these changes.

Changes in the composition of estate tax returns over time due to repeated increases in the exemption present a practical complication for measurement because lower. But it wouldnt be a surprise if the estate tax. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

Taxable Estates Over Time. Under Joe Biden theres a high chance the estate tax threshold may go back down. Because the BEA is adjusted annually for inflation the 2018.

The estate tax is imposed only on the part of the gross non-resident aliens estate that at the time of death is situated in the United States. If that individuals estate were. By 2025 the Tax Cut And Jobs Act will expire.

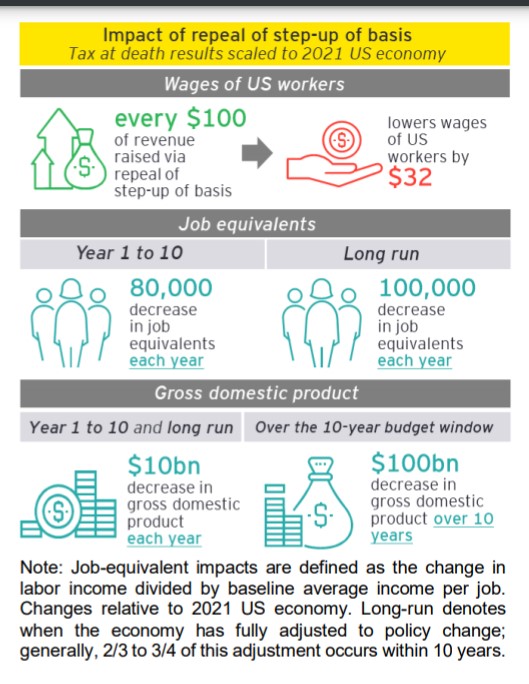

The revenue portion of the Build Back Better Act BBB that is moving along dramatically changes the landscape for transfer taxes ie. The Patient Protection and Affordable Care Act added an additional 38 percent. Impact was expected to lessen over time with total revenue loss of 479 million over three years.

The first is the federal estate tax exemption. The current top tax rate on estate assets above the exclusion amount is 40. The Estate Tax is a tax on your right to transfer property at your death.

The tax reform law doubled the BEA for tax-years 2018 through 2025. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021.

1 Any funds after that will be taxed as they pass. Transfer of Property Made several. As Chart 3 shows in 1916 only estates over 1 billion in todays wealth would have been taxed at the top rate of 10 percent.

Since 2018 estates are only taxed once they exceed 117 million for individuals. 25 million in first year 0 after three years. Estate Tax Rate Increase.

234 million for married couples at a top rate. The 2017 tax act Public Law 115-97 doubled the exemption amount for the estate tax through the end of 2025. The first 1 million.

Some proposals would have reduced the estate and gift tax exemption amount from its current level of 1206 million per taxpayer to 35 685 million per taxpayer. The expected proposal would increase the top tax rate to 45. The American Taxpayer Relief Act of 2012 increased the highest income tax rate to 396 percent.

Scheduled Changes to Estate and Gift Taxes. Contrast that with the top rate of 55 percent on. It was repealed but reinstituted over the years often in response to the need to finance wars.

The State Of Estate Taxes The New York Times

Four More Years For The Heightened Gift And Tax Estate Exclusion

Estate Tax Changes Under Review Secure The Current Benefits Now Southpac Group

The State Estate Tax A Leveler For Democracy Economic Opportunity Institute Economic Opportunity Institute

Federal And Connecticut Estate Tax Law Changes That Could Affect Your Family S Estate Northeast Law Center

2022 Estate And Gift Tax Exclusions Will Rise Cincinnati Estate Planning

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

The State Estate Tax A Leveler For Democracy Economic Opportunity Institute Economic Opportunity Institute

Biden Tax Plan May Leave Estate Tax Alone But Kill Step Up Provision Insurancenewsnet

Estate Tax Current Law 2026 Biden Tax Proposal

In Light Of House Ways And Means Committee Proposals The Time To Act Is Now

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Estate Taxes Under Biden Administration May See Changes

The Estate Tax May Change Under Biden Affecting Far More People The New York Times

Senate Bills Propose Changes To Estate Tax Wealth Management

How Estate Tax Changes Could Affect You And Your Family

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Estate Tax Law Changes What To Do Now

Long Islanders Be Aware Of Estate Tax Changes Long Island Estate Planning